California Last Will and Testament Forms – Many individuals overlook the importance of a last will and testament, yet it is imperative for managing your estate and providing for your loved ones after your passing. Using appropriate California last will and testament forms ensures that your final wishes are respected, potentially reducing conflicts and confusion among heirs. This post will guide you through the process, outlining the necessary forms, legal requirements, and the benefits of having a well-structured will in place. Ultimately, securing your legacy begins with understanding these key components tailored to your personal needs.

Key Takeaways:

- California offers standardized Last Will and Testament forms that simplify the estate planning process for residents.

- Wills must be signed by the testator and witnessed by at least two individuals who are not beneficiaries to be legally valid in California.

- It’s important to regularly update a will to reflect significant life changes, such as marriage, divorce, or the birth of a child.

- California allows for handwritten wills (holographic wills), but they must meet specific requirements to be enforceable.

- Legal assistance is advisable when drafting a will to ensure all provisions comply with California law and accurately reflect the testator’s wishes.

Legal Requirements for California Wills

Before creating your Last Will and Testament in California, it’s vital to understand the legal requirements that must be met for your will to be considered valid. This includes specific provisions regarding the individual’s age, mental capacity, the format of the document, signatures, and the presence of witnesses. Adhering to these regulations ensures that your wishes will be honored and reduces the possibility of challenges in court.

Age and Mental Capacity

Capacity is a fundamental aspect of creating a valid will in California. You must be at least 18 years old and of sound mind when drafting your will. This means you should understand the nature of the document, the assets you’re distributing, and the beneficiaries involved. If you lack mental capacity, your will may be deemed invalid, potentially leaving your estate to be distributed according to state laws.

Written Document and Signatures

At its core, a will in California must be a written document that clearly outlines your wishes concerning your estate. It is critical that you sign your will, as an unsigned document may lack legal standing. Furthermore, California allows for both handwritten (holographic) and typed wills, provided they fulfill the necessary criteria.

A properly executed will can be a typed or handwritten document, but ensure it contains clear directives about your estate. It is advisable to use plain language to avoid misunderstandings. To make your will legally binding, you must sign it yourself; electronic signatures are not valid for wills in California. This step is vital, as an unsigned will can lead to legal complications and confusion regarding your intentions.

Witness Requirements

After you create your will, you must have it signed in the presence of at least two witnesses who are not beneficiaries. These witnesses will affirm your signature and ensure that you were of sound mind when you created the will. It’s important that these individuals are trustworthy and can attest to your intentions if necessary.

Also, the witnesses should be at least 18 years old and should not have any stake in your estate. This requirement is designed to protect against potential conflicts of interest. If there is a dispute regarding the validity of your will, having competent witnesses can significantly bolster your case and affirm the legality of your directives. Ensure that the witnesses clearly understand their role and the importance of their signature to avoid any complications later on.

FREE Alabama Last Will and Testament Forms

FREE Last Will and Testament Forms

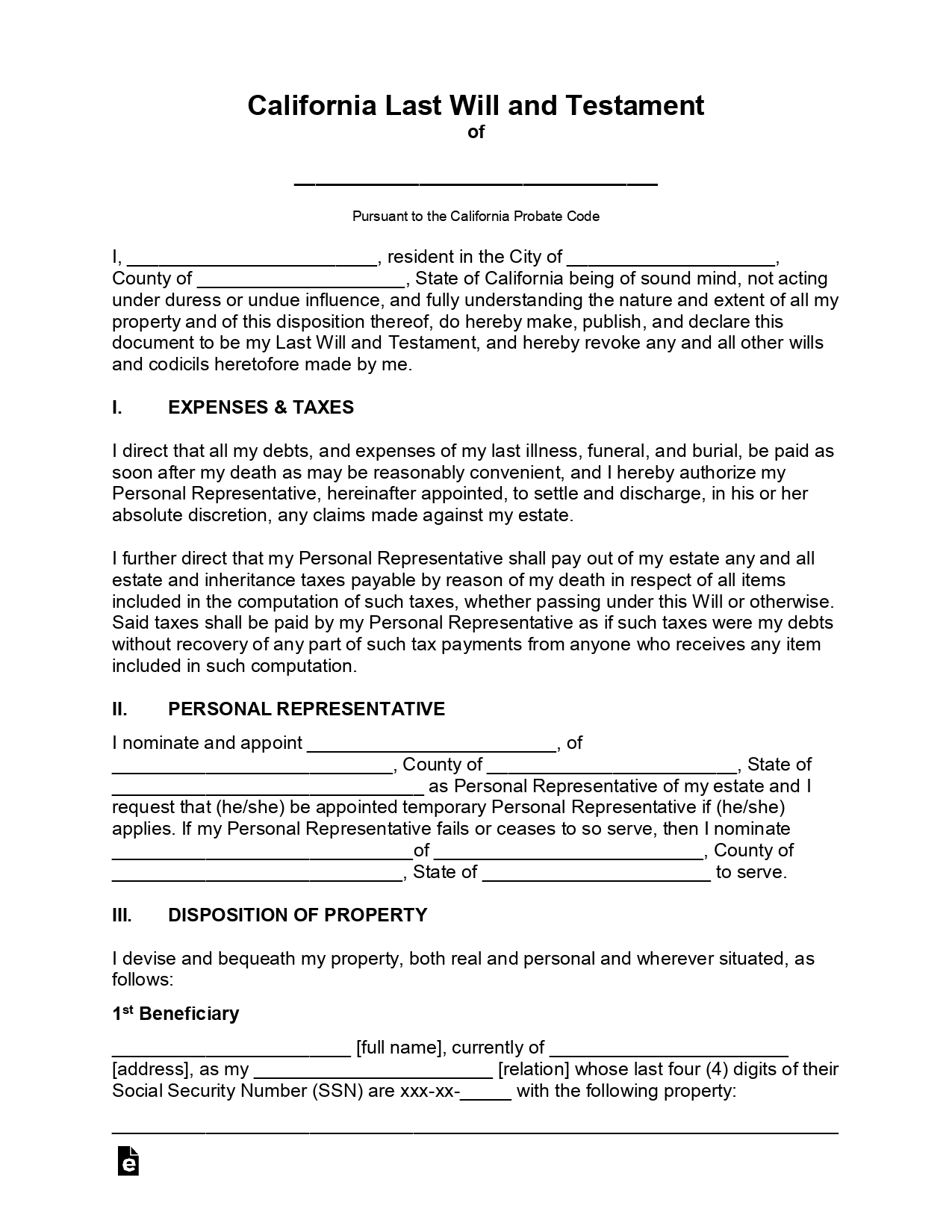

California Last Will and Testament Forms (PDF Version) (8 downloads )

California Last Will and Testament Forms (Microsoft Word) (9 downloads )

Note: This sample form is provided by eForms.com.

Essential Components

Your California Last Will and Testament must contain several crucial components to ensure it is valid and meets your wishes. These components include your personal information, details about your beneficiaries, instructions for asset distribution, the appointment of an executor, and any necessary witness signatures. Each element plays a significant role in guiding how your estate will be handled upon your passing, making it imperative that you include all required sections properly.

Testator Information

Behind every valid will is the testator’s information, which includes your full name, address, and date of birth. This information serves to identify you unequivocally as the person creating the will and helps avoid any confusion or disputes regarding your intentions after your passing.

Beneficiary Designations

Among the primary components of your will are beneficiary designations, which specify who will inherit your assets. Clearly naming your beneficiaries is crucial to ensure that your wishes are honored and to prevent any potential misunderstandings or conflicts among your heirs.

This section should provide the complete names and relationship of each beneficiary to you. You may also include alternate beneficiaries to safeguard against the possibility that your primary beneficiaries predecease you or are otherwise unable to receive their inheritance. This thoughtful approach can help streamline the distribution process and reduce the chances of disputes.

Asset Distribution

Above all, asset distribution outlines how you want your property and belongings distributed among your chosen beneficiaries. This segment is vital to convey your intentions explicitly, making it easier for your executor to carry out your wishes effectively.

For instance, you might want to allocate specific items, such as a family heirloom or real estate, to particular beneficiaries. Alternatively, you can choose to divide your estate evenly among them. Clarity in your asset distribution ensures that your loved ones receive what you intended, minimizing the potential for disputes and confusion following your death.

Executor Appointment

Components of your will also include the appointment of an executor, who will oversee the administration of your estate. This individual plays a significant role in ensuring your wishes are followed through and that your assets are distributed accordingly.

Understanding the responsibilities of an executor is vital, as this person will be tasked with paying off debts, filing taxes, and distributing assets. Ideally, you should select someone you trust to handle these duties competently. Additionally, consider appointing a backup executor in case your primary choice is unable or unwilling to serve when the time comes. This strategy will help maintain the integrity and smooth processing of your estate, ensuring your wishes are respected after your passing.

Special Provisions

To ensure that your personal wishes are respected, incorporating special provisions in your California Last Will and Testament is imperative. These provisions can encompass various elements like guardianship for minor children, trusts for asset management, and arrangements for your pets. By outlining these unique instructions, you maintain control over how your estate is handled, providing peace of mind for both you and your loved ones.

Guardian Designations

For parents, selecting a guardian for your minor children is a vital aspect of estate planning. You must specify your preferred guardians in your will to ensure your children are cared for according to your wishes, should the need arise. This choice can reflect your values, beliefs, and the qualities you find imperative in a caregiver.

Trust Establishment

Any person can create a trust through their will to manage assets for beneficiaries, ensuring their financial needs are met over time. Establishing a trust can offer significant benefits, such as minimizing taxes and streamlining the distribution process, making it a powerful tool in estate planning.

Designations within your trust can include stipulations on how and when your assets are distributed, whether for education, health care, or specific milestones. This structure not only provides for your beneficiaries but also protects their inheritance from potential mismanagement or creditor claims. Working with an attorney can help you create a trust that aligns with your goals.

Pet Care Instructions

Around 70% of U.S. households own pets, and you may want to consider their well-being in your estate plan. Creating provisions for pet care ensures that your beloved animals are cared for and respected, even in your absence. You can specify caregivers, financial support for their care, and any special needs they might require.

Trust your instincts about your pet’s future when drafting care instructions. You can designate a trusted friend or family member to take on their care and allocate funds through a trust to cover necessary expenses such as food, veterinary care, and grooming. This shows your commitment to their well-being and provides peace of mind that they will be looked after as you would have wanted.

Modifying and Revoking Wills

Keep in mind that your last will and testament isn’t set in stone; you have the ability to modify or revoke it as circumstances change in your life. Whether due to marriage, divorce, or changes in your financial situation, updating your will is vital to reflect your current wishes.

Codicils

Before you think about drafting a completely new will, consider using a codicil, which is a legal document that makes amendments to your existing will. A codicil can clarify, add, or revoke specific provisions without starting over entirely.

Revocation Procedures

Wills can be revoked formally through specific procedures or informally by actions such as destroying the document. If you choose to revoke your will, it’s important to clearly communicate your intentions to avoid confusion among your heirs.

This is particularly significant because unclear revocation could lead to disputes, potentially causing your assets to be distributed against your wishes. You might choose to complete a new will, which should explicitly state that it revokes any previous wills. Ensure that all copies of the old will are destroyed or marked as revoked to prevent any future conflicts.

Updating Beneficiaries

Above all, regularly updating your beneficiaries is vital as life events unfold. Changes in relationships or financial status can impact how you wish to allocate your assets after you pass.

Understanding how to update beneficiaries can help ensure that your assets are distributed according to your current preferences. You should review your beneficiary designations in insurance policies, retirement accounts, and other vehicles regularly, as these designations often supersede your will. Keeping your beneficiaries aligned with your most recent wishes can prevent unintended distributions and family disputes.

Filing and Storage

For ensuring that your California Last Will and Testament is effective, proper filing and storage are vital. Once you complete the will, you must keep it in a safe and accessible place. This ensures that your wishes are followed after your passing, and it also alleviates any potential disputes among heirs.

Safe Storage Options

Beside keeping your will at home, consider using a safety deposit box at a bank or hiring a professional document storage service. Both options offer protection against theft and fire damage while making the document readily available for your executor upon your death.

Notifying Executors

Notifying your chosen executor about your will is necessary to ensure they know their responsibilities. You should discuss your wishes and the location of your will, so your executor can promptly access it when the time comes.

Consequently, having an open conversation with your executor allows them to understand your intentions better and prepares them for their role. This proactive approach can also help in addressing any questions they may have, ensuring that they honor your wishes without confusion or complications in the future.

Registration Requirements

Between understanding California’s registration laws and taking the right steps, you can reinforce the legitimacy of your will. Although not mandatory in California, registering your will with a local court may provide added protection against challenges.

A registered will may be less likely to be contested, as it demonstrates a formal process was followed. If you choose to register, consult an attorney to ensure you meet all necessary requirements and maximize the advantages of registration.

Frequently Asked Question (FAQs)

1. What is a Last Will and Testament in California?

A Last Will and Testament is a legal document that outlines how an individual’s assets and responsibilities will be handled after their death. In California, it allows you to appoint an executor, name guardians for minor children, and specify how you wish your property to be distributed among beneficiaries.

2. Do I need a lawyer to create a Last Will and Testament in California?

While it is not required to have a lawyer to create a Last Will and Testament in California, it is advisable for those with complex estates or specific legal concerns. Legal professionals can provide guidance to ensure that the will is valid, legally binding, and meets all necessary state requirements.

3. What are the requirements for a valid Last Will and Testament in California?

In California, a Last Will and Testament must be in writing, signed by the testator (the person making the will), and witnessed by at least two individuals who are not beneficiaries of the will. Additionally, the testator must be at least 18 years of age and of sound mind when signing the will.

4. Can I change or revoke my Last Will and Testament once it is made?

Yes, you can change or revoke your Last Will and Testament at any time before your death. This can be done by creating a new will that explicitly revokes the previous one or by creating a codicil (an amendment) to make specific changes. It is important to follow legal procedures to ensure the modifications are valid.

5. What happens if I die without a will in California?

If an individual dies without a will in California, the estate is considered ‘intestate.’ This means that California’s intestacy laws will dictate how the estate is distributed. Typically, assets will be divided among surviving family members according to a predetermined hierarchy established by state law.

6. Are handwritten wills valid in California?

Yes, handwritten wills, known as holographic wills, can be valid in California as long as they are signed by the testator and the material provisions are in the testator’s handwriting. However, they must also meet the same requirements as formal wills and can be more challenging to validate in court.

7. Can I use an online template for my Last Will and Testament in California?

Yes, many individuals opt to use online templates to create their Last Will and Testament. While these templates can be a useful starting point, it is recommended to ensure that they comply with California’s legal requirements. Consulting with an attorney can help mitigate potential issues that may arise from using generic forms.